This year’s back-to-school shopping season has presented a considerable challenge for inflation-weary parents in the US. Despite chatter about alleviating inflation rates, the reality of rising prices tells a different story.

As families hunt for school supplies, apparel, and other essential items for the academic year, the financial strain remains palpable. Experts note that elevated prices coupled with extensive shopping lists have compelled many parents to be more discerning about their purchases, expenditure thresholds, and preferred shopping venues. Essentially, shoppers are looking for more value for their money with every purchase. According to the National Retail Federation’s 2023 projection, this back-to-school season is poised to be the most financially demanding one to date. The forecast anticipates total spending exceeding $135 billion, marking an increase of over $24 billion compared to the previous year.

At DataWeave, we continually monitor and analyze pricing activity among retailers across popular shopping categories. Our recent study delved into the pricing trends in the back-to-school category, which includes backpacks, fundamental school supplies, binders, planners, writing instruments, and more. The aim was to understand how the costs of back-to-school essentials have shifted in 2023 in comparison to 2022.

Pricing of Back-to-School Products in 2023

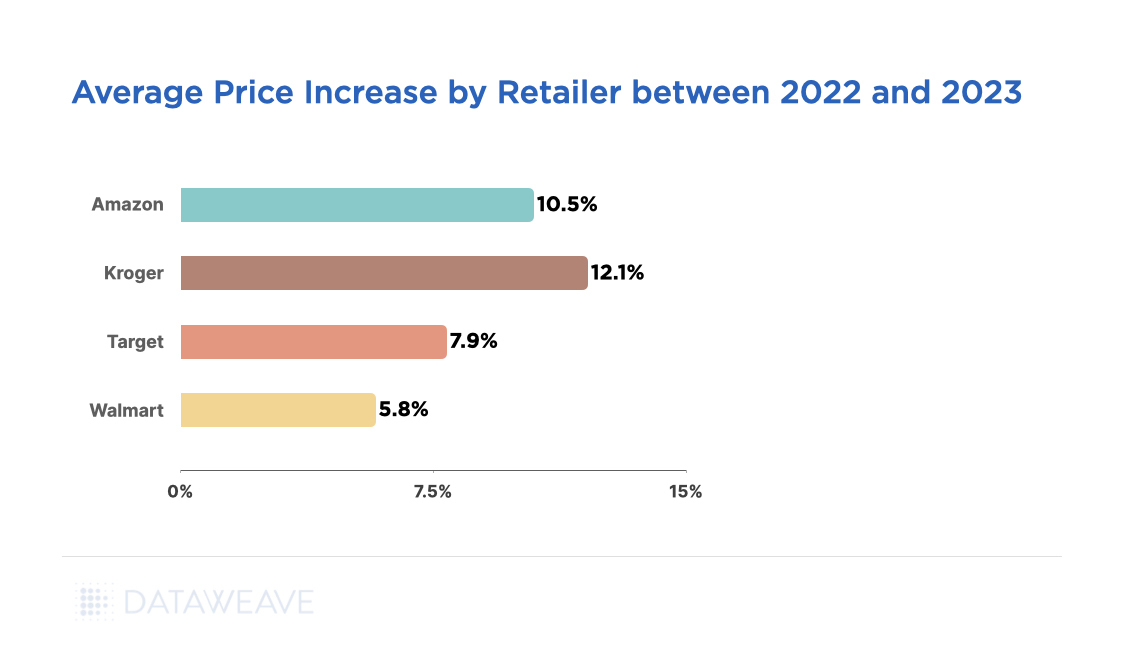

Our analysis, spanning 1200 products across major retailers such as Amazon, Walmart, Kroger, and Target reveals an average price surge of 9.8% in 2023 compared to the previous year.

This upward pricing trend can be attributed to retailers’ strategic efforts to guarantee product availability and uphold quality during a period of heightened demand. As the back-to-school season sparks a surge in shopping activity, retailers like Kroger, Amazon, and Walmart are likely adjusting prices strategically to align with the expenses incurred in securing adequate supplies, managing logistics, and meeting operational demands.

Kroger led the way with a 12.1% price hike, the most significant among the scrutinized retailers. It was followed by Amazon with an average increase of 10.5% and Target with 7.8%. Walmart remains the outlier, with the smallest price increases for back-to-school products in 2023.

Pricing across Categories and Subcategories

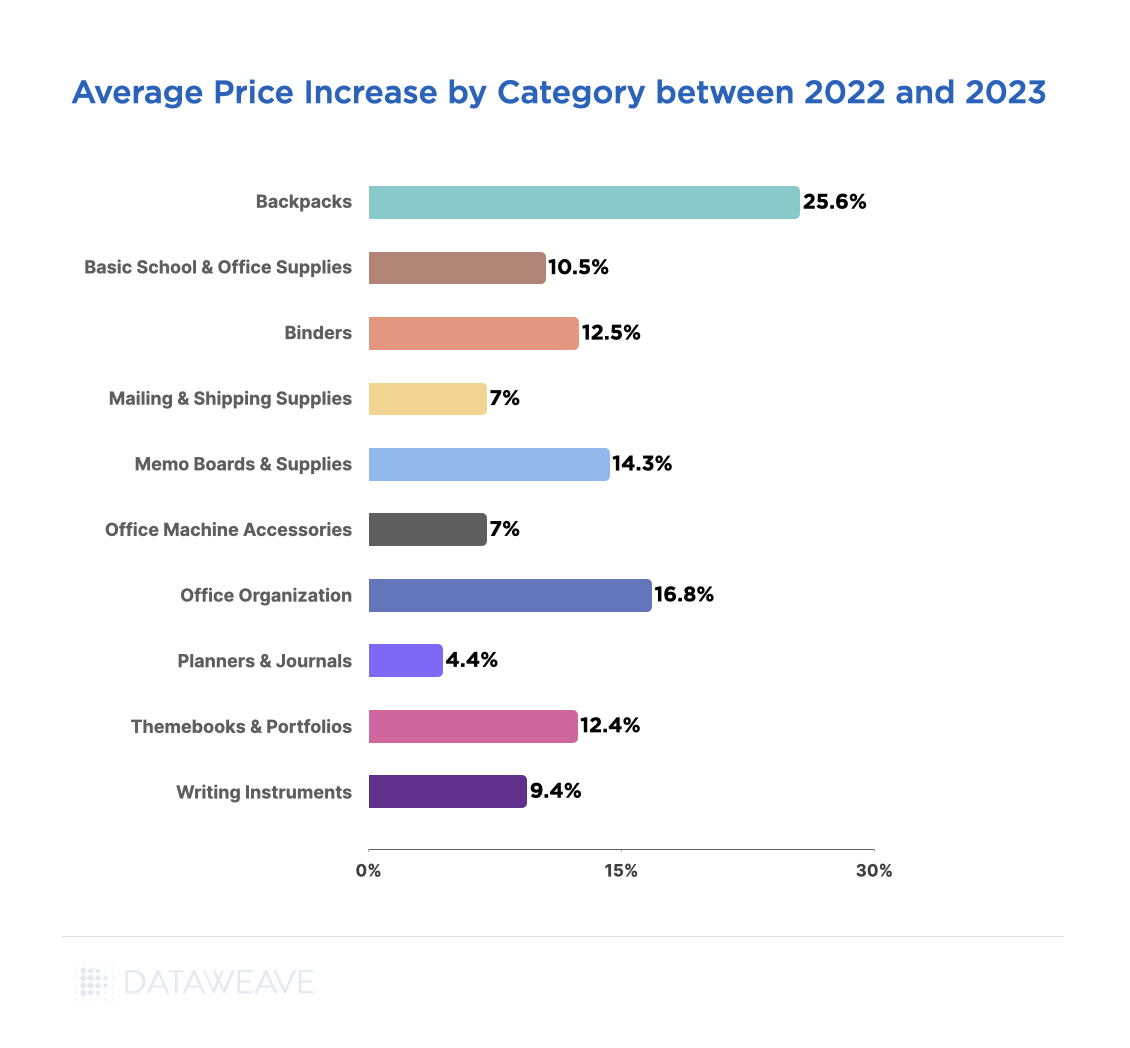

Among the various categories examined, backpacks have experienced the most pronounced escalation, with prices soaring by a substantial 25%. Within the top 10 highest priced backpacks we looked at, the most substantial price hikes were observed for brands like The North Face (44%) and Fjallraven (33%).

The Office Organization category also witnessed a significant price surge of 16.8%, attributed to subcategories like File Folders and Desk Accessories, which saw respective price hikes of 31.3% and 25.2%.

Categories like Memo Boards & Supplies (14.3%), Binders (12.5%), and Themebooks & Portfolios (12.4%) have likewise encountered notable price hikes. On the other end of the spectrum, Planners and Journals saw a modest rise of 4.4%, while Mailing and Shipping Supplies and Office Machine Accessories experienced comparatively lower price increases at 7% each.

Interestingly, while items like Journals and Writing Instruments maintain popularity year-round, Backpacks and Memo Boards are particularly sought after during the back-to-school season, contributing to more substantial price hikes in these categories.

On the other hand, consumers are consistently on the lookout for cost savings and deals from retailers, especially as they deal with inflationary pressures. In response, Kroger, Target, and Walmart have introduced back-to-school savings initiatives. For instance, Kroger is offering more than 250 items for less than $3 and some items for just $1, encompassing essentials such as paper, pencils, and glue sticks. Lower price increases across categories like journals and writing essentials could be attributed to these initiatives.

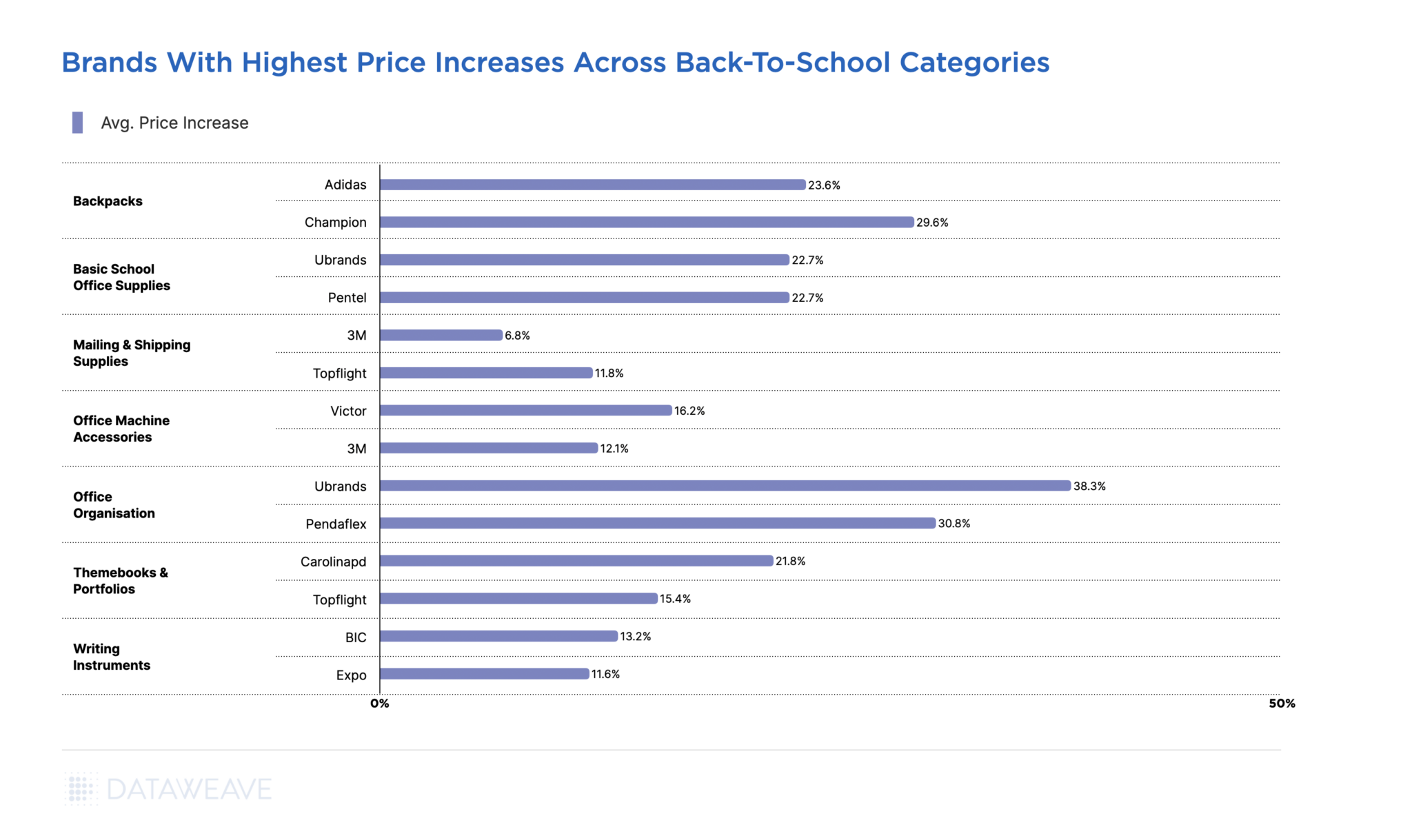

Brands with the Highest Price Increases across Categories

Across various back-to-school categories, some brands stand out with significant price increases. For instance, in the Office Organization category, Ubrands leads the pack with a substantial 38.30% surge, followed by Pendaflex at 30.80%. Meanwhile the Backpacks category sees Champion and Adidas recording significant price jumps of 29.6% and 23.6%, respectively.

Ubrands and Pentel from Basic School and Office Supplies Category also record high price increases at 22.70%, followed by Carolinapd from the Themebooks & Portfolios Category at 21.08%. 3M in Mailing in Shipping Supplies shows the lowest price increase at 6.80%.

Interestingly, the ever popular Writing Instruments category showcases BIC at the forefront, exhibiting the most notable price escalation of 13.2%. Expo trails closely at 11.6%, while Uniball demonstrates an 11.4% increase. Even Sharpie, a beloved writing brand, displays a modest price uptick of 9.3%.

The average price increments seen across brands mirror the overarching trend of increased costs throughout back-to-school categories.

Navigating the Competitive Pricing Landscape During the Back-To -School Season

Given the challenging pricing landscape during the back-to-school season, retailers would be wise to provide lower-cost alternatives alongside popular brand names. This allows parents to easily make substitutions while adhering to a school supplies list.

With our competitive pricing intelligence solution, retailers can confidently analyze and monitor their prices relative to competition, ensuring they maintain a leadership position in pricing within their desired set of products, while posturing for margins with other products.

To learn more about how we can help, reach out to us today!

Book a Demo

Login

For accounts configured with Google ID, use Google login on top.

For accounts using SSO Services, use the button marked "Single Sign-on".