As we move into the second quarter of 2024, the US energy landscape is poised for notable shifts that will impact gasoline and diesel prices. The shift towards renewable energy sources, evolving consumer preferences, and volatile global market forces are all converging to reshape the fuel retail industry.

For fuel retailers, understanding these projections is crucial – changes in consumer demand and cost pressures can significantly affect their bottom line. In this article, we provide insights on the factors shaping the fuel pricing environment for the remainder of the year, covering a variety of fuel types.

Gasoline Prices: A Downward Trend Ahead

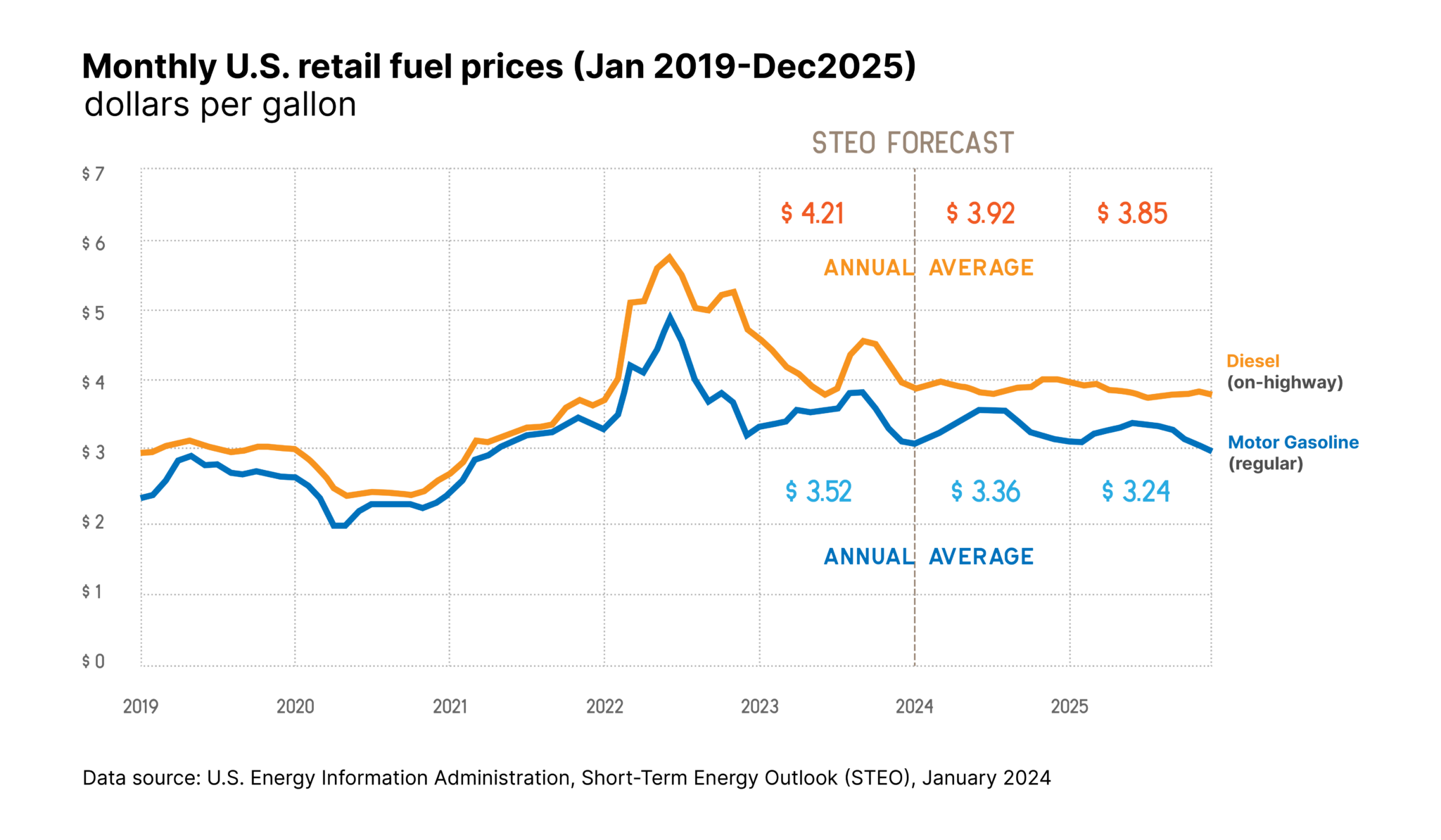

According to the January Short-Term Energy Outlook by the EIA, US retail gasoline prices are projected to decline in 2024. Similarly, the forecast also predicts reduced gasoline consumption in 2025. This is attributed to a significant increase in inventories, thanks to expanded refinery capacity. US operable refinery capacity has grown from 18.06 million barrels per day in January 2023 to 18.31 million barrels per day by December 2023.

Meanwhile, the World Bank reports that global trade growth in 2024-25 is expected to be only half the average in the decade before the pandemic, leading to reduced consumption and demand.

The increase in supply, coupled with this dip in demand and consumption expected in 2025, sets the stage for further price reductions. Such expansion not only enhances supply but also alleviates price pressures for consumers.

Diesel Dynamics: Supply Up, Prices Down

Similar supply-side dynamics are at play in the diesel market, with retail prices expected to fall in both 2024 and 2025. Despite a forecasted uptick in US diesel consumption in these two years, an increase in production capacity and easing inventory strains are likely to keep prices in check. This is particularly noteworthy, as diesel fuel plays a critical role in transportation and logistics, underpinning the movement of goods and services nationwide.

Crude Oil and Crack Spreads: The Refining Equation

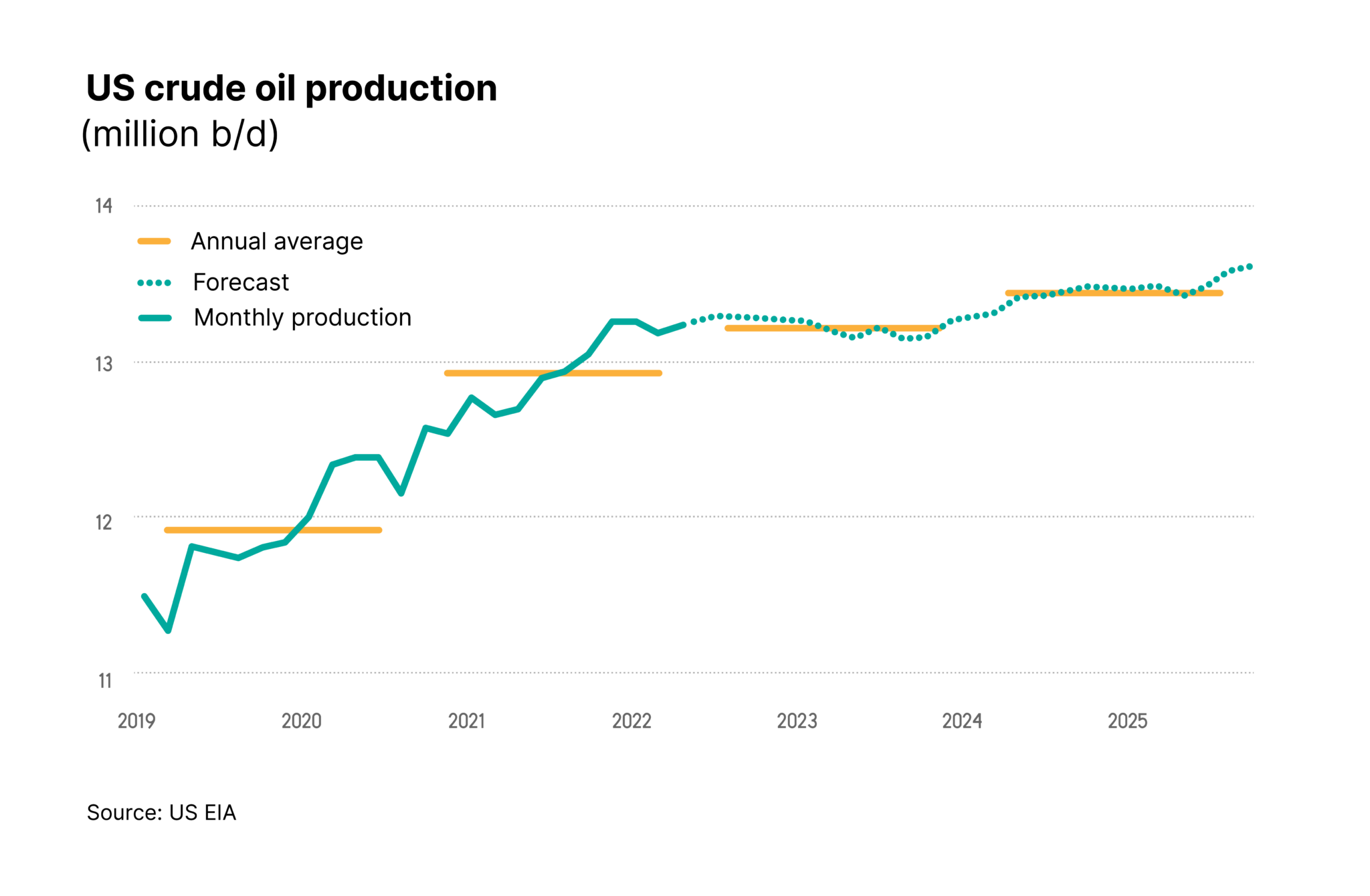

Crude oil prices, a pivotal factor in the fuel price equation, are expected to mirror 2023 levels through 2024.

The anticipated decrease in gasoline and diesel prices is largely attributed to narrowing crack spreads—the differential between wholesale fuel prices and crude oil. A lower crack spread signifies reduced refining costs, a welcome development for both refiners and consumers. This expectation is grounded in the increasing availability of refinery capacity and, consequently, fuel supply, even as demand shows signs of tapering off.

Global Influences and Economic Implications

The outlook is further buoyed by new refinery capacities coming online internationally, particularly in the Middle East. This global increase in refined product supplies is poised to ease price pressures for consumers not just domestically but across international markets. Interestingly, this forecast comes at a time when gasoline consumption is expected to remain flat or slightly decrease, a rare occurrence in the context of positive economic growth. This decoupling of fuel consumption from economic expansion highlights evolving consumer behaviors and efficiency gains across the automotive sector.

Looking Ahead: Uncertainties and Transformations

While the projections offer a glimpse into a future of potentially lower fuel prices, they are not without uncertainties. Factors such as crude oil price fluctuations, refinery shutdowns, and logistical challenges could sway outcomes.

The projected decrease in US gasoline and diesel prices presents both opportunities and challenges.

- For American consumers, lower fuel costs offer relief for household budgets and transportation expenses, potentially freeing up disposable income and stimulating broader economic activity.

- However, these pricing trends pose a need for strategic planning and adaptation within the US energy sector. Companies must navigate shifting supply dynamics and the ongoing transition towards renewable energy sources – a pivotal chapter in the quest for sustainable and affordable solutions.

- Energy firms will need to carefully analyze the implications, aligning their business models through refining capacity expansions, logistical optimizations, and a focus on renewable fuels.

Staying Ahead of Competition with Fuel Price Tracking

In this evolving landscape, closely tracking fuel prices and having access to up-to-date data is crucial for informed decision-making and staying competitive in the market for fuel retailers. While prices may go down in the long- to medium-term, ensuring short-term price competitiveness at a hyperlocal level is essential for gas stations and convenience stores navigating the changing tides.

DataWeave’s real-time fuel pricing data, covering a wide range of fuel types from gasoline to diesel and updated as frequently as every 30 minutes, empowers retailers to quickly adapt to market changes and remain strategically aligned with evolving consumer preferences.

By closely monitoring hyperlocal fuel price fluctuations across their coverage areas, retailers can quickly adapt their pricing strategies to remain competitive and align with shifting consumer behaviors.

Further, DataWeave’s real-time fuel pricing intelligence can help retailers understand the relationship between crude oil prices, crack spreads (the differential between wholesale fuel prices and crude oil), and their own pricing strategies. Our solution offers real-time insights and analytics to help retailers navigate the evolving fuel pricing landscape.

Visit our recently launched U.S. Fuel Price Interactive Dashboard which displays weekly fuel prices across 400+ unique ZIP codes, delivering insights into price changes by region, store, fuel type, and other dimensions.

To learn more about DataWeave’s solutions or to discuss how we can support your fuel retail business, reach out to our team today!

Book a Demo

Login

For accounts configured with Google ID, use Google login on top.

For accounts using SSO Services, use the button marked "Single Sign-on".