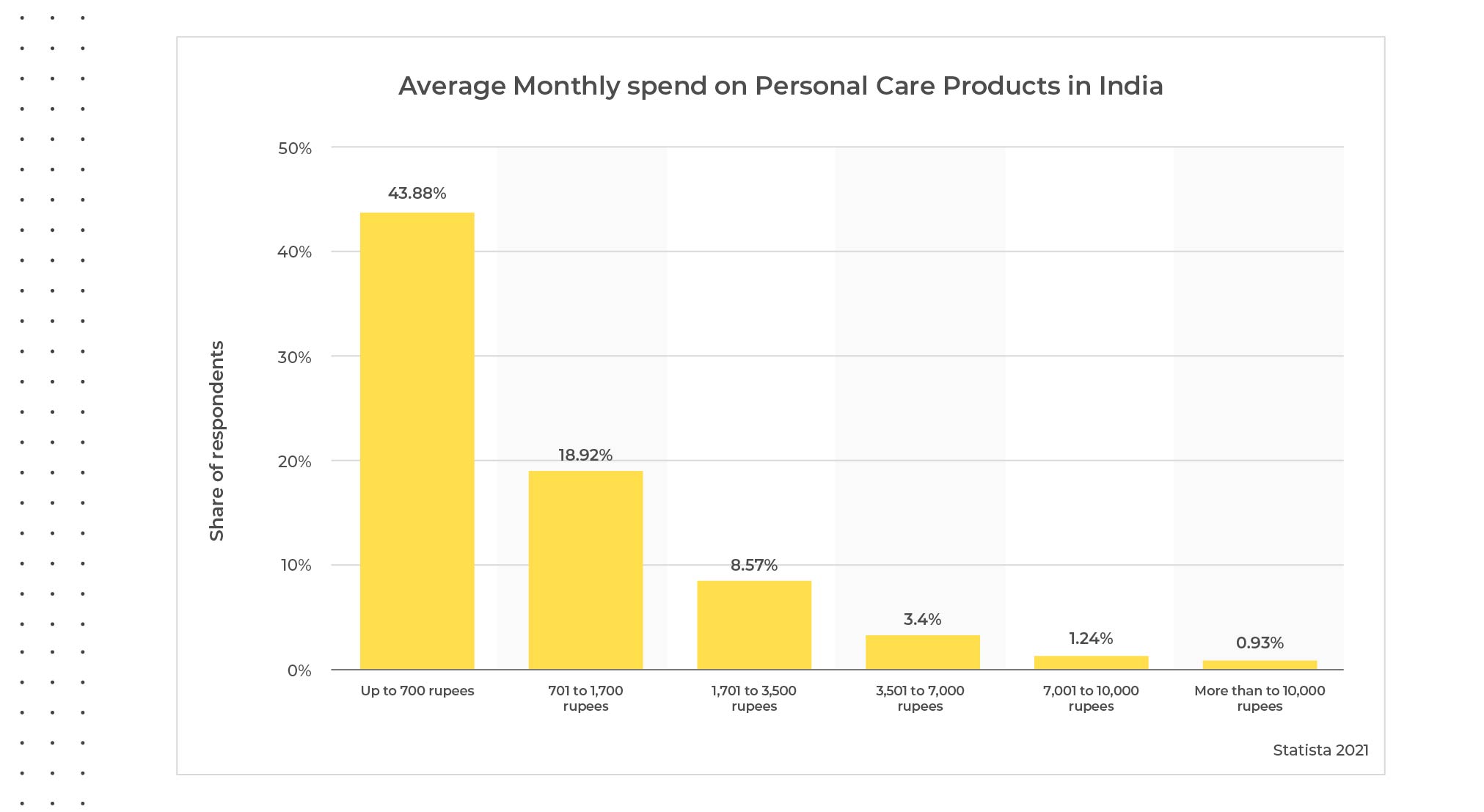

Growing awareness of personal hygiene and changing lifestyles has contributed to a significant development of India’s cosmetics, beauty, and personal care products. The Indian cosmetic industry reached a value of USD $26.1 bn in 2020. The major boom in sales is because of rising digitization, social media marketing, and the advent of eCommerce beauty platforms. However, the increase in demand and technological advancements has led to a competitive landscape for Indian and international brands competing for digital and physical channels. As of February 2019, 18.92% of respondents spent between 700 to 1700 rupees, and 43.9% spent up to 700 rupees monthly on cosmetics and personal care products in India.

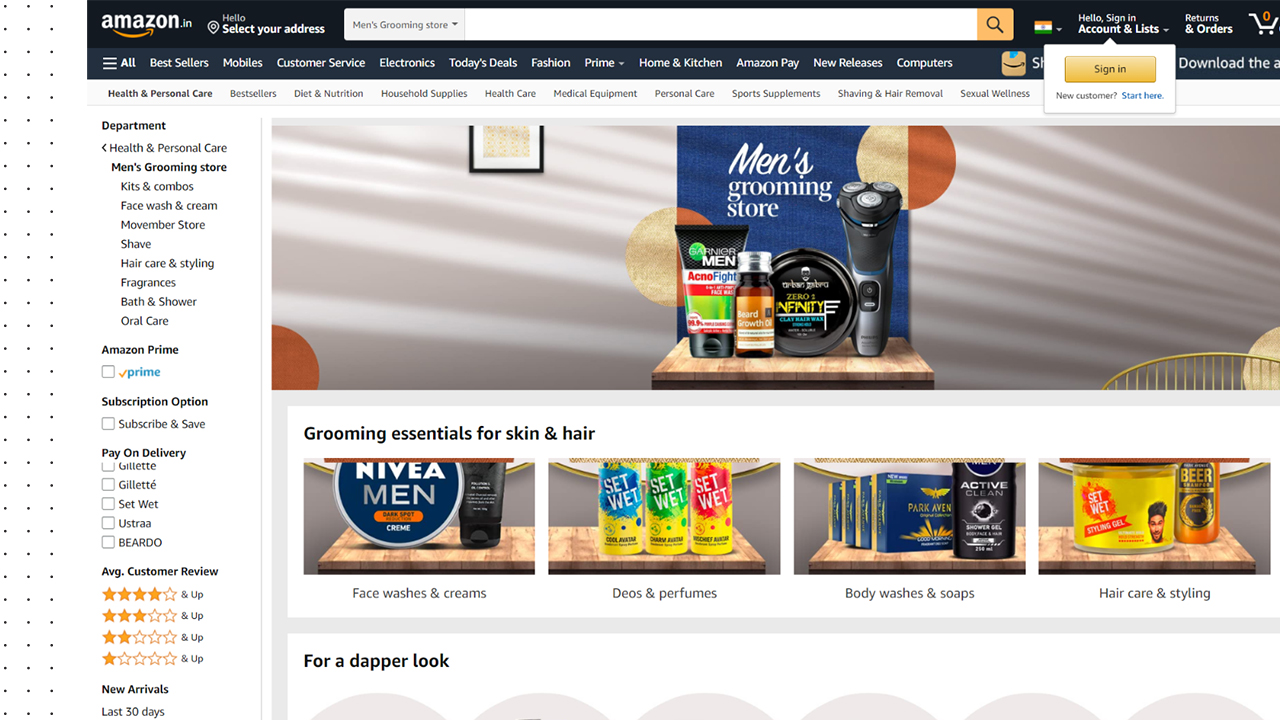

Shattering stereotypes and gender norms, India is also seeing a revolution in the male grooming industry, which is expected to reach INR 319.82 bn by 2024. The D2C market is expanding beyond metropolitan cities, and at present both D2C brands and startups have launched over 177 new products for men. “We realized there is an opportunity to create India’s first experiential brand exclusive for men,” says Hitesh Dhingra, Co-founder, The Man Company. He adds ecommerce business has grown almost by 200 percent. In a similar vein, Shantanu Deshpande, founder, and CEO, Bombay Shaving Company, concurs and adds the pandemic boosted online sales. He says that it has become easier for the company to compete with big brands on marketplaces like Amazon and Flipkart.

With the onset of the pandemic, it has become more and more important for these D2C brands to have a strong digital presence and an even stronger Digital Shelf when selling on platforms like Amazon, Flipkart, Nykaa, and the likes. On these marketplaces, brands need to track critical KPIs like product discoverability, stock status & availability, reviews and ratings, pricing & promotions to make sure they’re optimizing product performance across all online channels to amplify their eCommerce growth.

So which beauty and grooming brands and categories have a strong Digital Shelf and are dominating on Amazon? Let’s take a look.

Methodology

- We tracked the first 250 products on Amazon against certain keyword searches specific to India’s Beauty & Grooming space.

– Keywords specific to women’s grooming: anti-aging Cream, Face Mask, Paraben-free Shampoo, Onion Hair Oil, Body Wash, Moisturizer

– Keywords specific to male grooming: Beard Oil, Hair Wax for men, Shaving Cream, After Shave Lotion, Beard Trimmer - Share of Search (SoS) – The percentage of products that appeared on the search results page on Amazon belonging to a brand against a specific keyword or category.

- Data Scrape time period: From 14th Oct 2021 to 10th Nov 2021

THE BEAUTY IS IN THE DATA

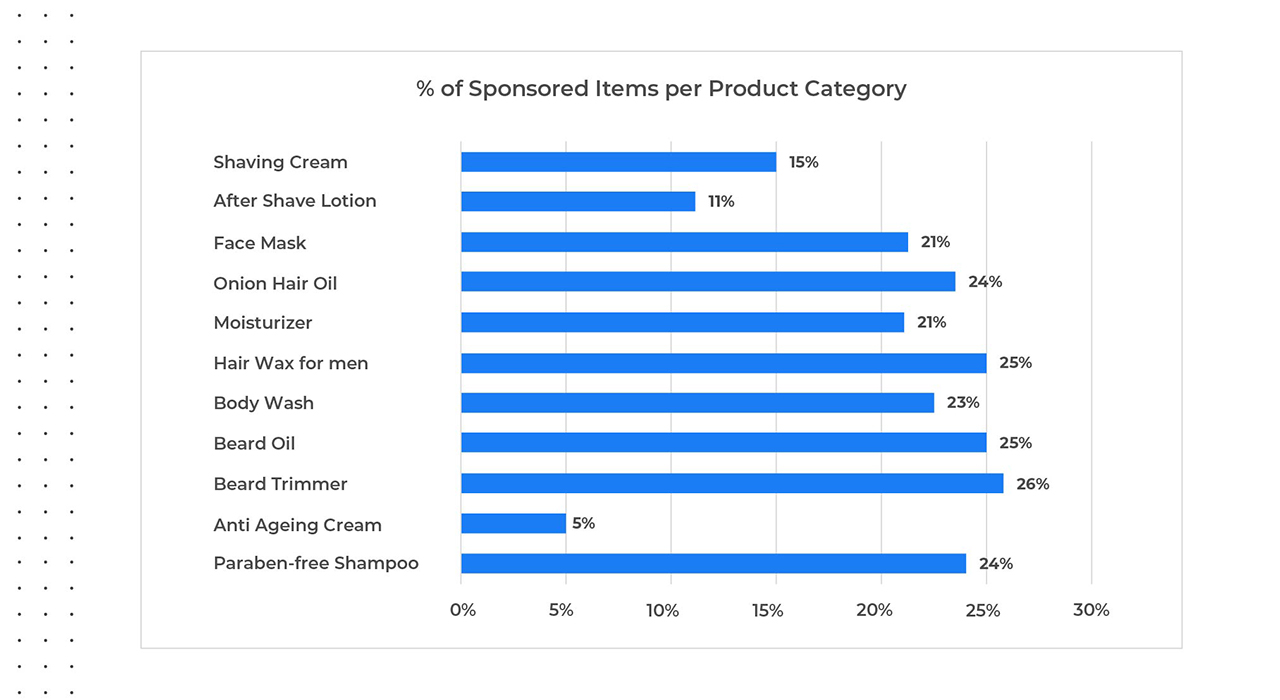

On Amazon, brands use sponsored ads to increase visibility and drive more sales. When we looked at the product category with the most aggressive ad spends, products in the men’s grooming category came out on top and had the maximum number of sponsored products. 26% of beard trimmers were sponsored, followed by Beard Wax and Beard Oil at 25%. During the lockdown, more men started searching online for new products and watching instructional videos on how to groom their beards or how to get a salon-like shave at home. Demand for razors and trimmers is up by 50% compared to last year,” said Sidharth S Oberoi, founder and CEO, LetsShave. In contrast, we saw that only 11% of after-shave lotions and 15% shaving creams were discounted.

For women, we saw a similar trend. 24% of products in the Paraben-free Shampoos and Onion Oil category was sponsored. In contrast, only 5% of anti-aging creams were sponsored. Additionally, 21% of products in the face mask category and 23% in body wash were sponsored.

Competition is fierce in these categories, making an artificial boost necessary for increasing discoverability. In fact, we saw that the competition was the fiercest in the face mask category, which had the highest “1st Page Change Rate.” It is an indicator of how much the results on the 1st page for a particular keyword change from time to time. This reflects higher competition and brands constantly updating their digital shelf KPIs to ensure their products appear on page 1. One of the biggest reasons why brands need to constantly gauge their online visibility is to track their sponsored & organic ranking compared to competitors.

Driving sales using a smart Discounting Strategy

Price can play a big role in the final purchase decision. So we looked at two things wrt price across all these beauty & grooming products.

- Which product Category had the maximum number of products on discount?

- … & how large were these discounts?

We saw that almost 55% of products in the body wash category & 46% of anti-aging creams were available at a discount. Beard Oil & Onion Hair oil had the least number of products discounted at 29% each.

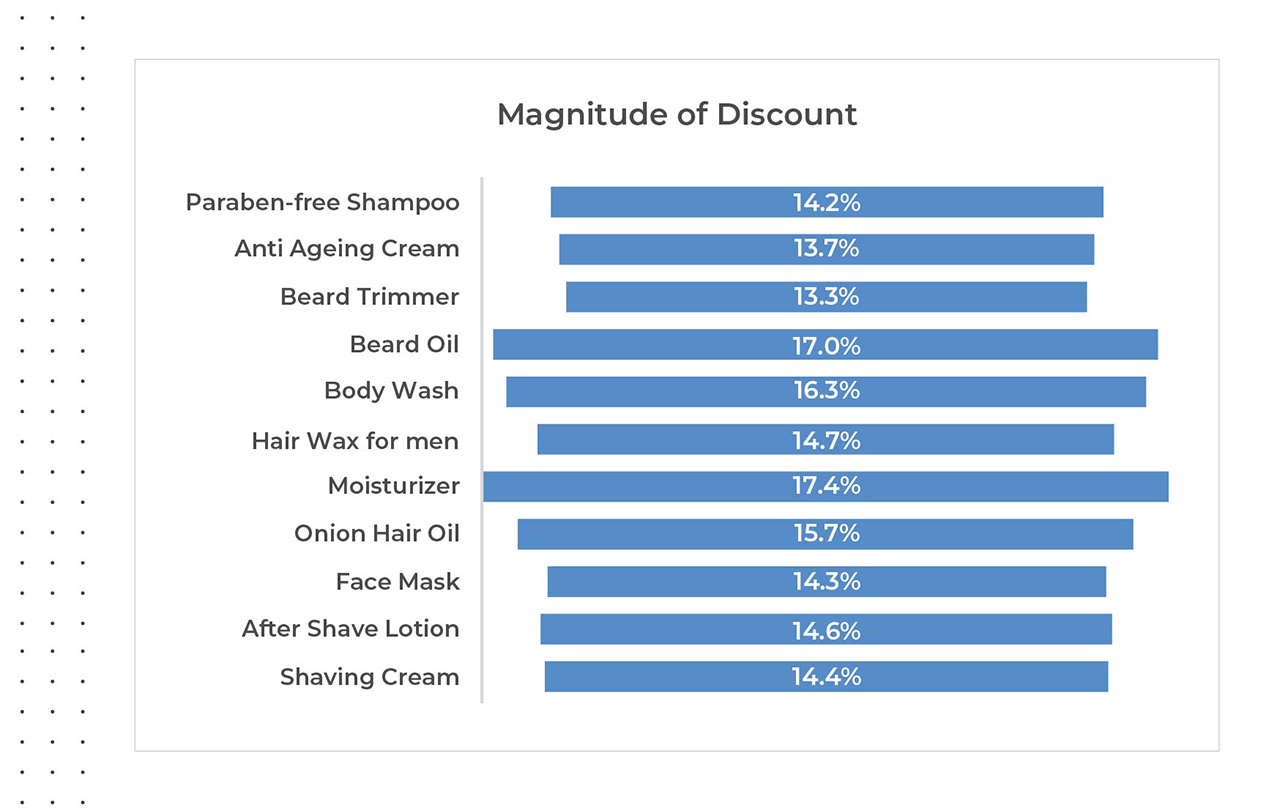

How high were these discounts? Let’s take a look.

The highest discount was seen in the beard oil and moisturizer category, with an average discount of 17% across all products. The average discount trend across most product categories ranged between 14 to 17%, so we did see some consistency there.

Digital channels provide transparent insights into pricing & promotions, which is why customers are constantly comparing prices across various brands before making a purchase. This is why it is crucial for brands to remain competitive by tracking & comparing promotional strategies with those of their rivals.

To Review or Not to Review?

Consumers worldwide don’t make a purchase decision without reading online reviews. Online reviews and ratings have become a significant milestone in the modern consumer shopping journey, and eCommerce brands can leverage reviews as valuable sales tools. Given a choice between loyalty programs, discounts, reviews, and free shipping, online shoppers say reviews are the most important factor while making a purchase. Consumers trust user-generated content (UGC) more than product information and videos created by brands.

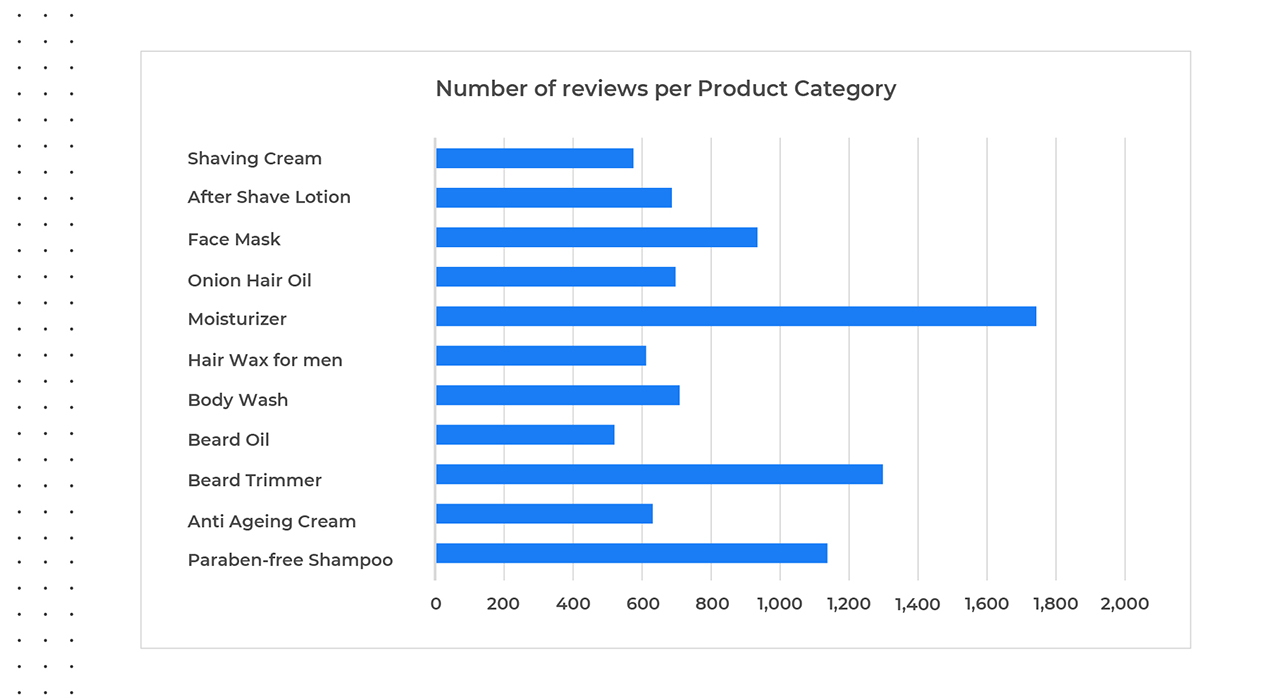

We looked at product reviews to check consumers of which categories are actively sharing their experience and found that three categories stood out — beard trimmers, moisturizers, and paraben-free shampoo. At the same time, beard oil was the product category with the least number of reviews.

Companies can build consumer trust by identifying and acting on negative feedback. But in order to do that, they first need to de-code and understand the collective sentiment behind these reviews. DataWeave’s AI-Powered solutions can help brands break down & analyze online reviews and give them a wealth of insights to enrich their market research as well as create a seamless customer experience.

UNDERSTANDING THE COMPETITION ON AMAZON

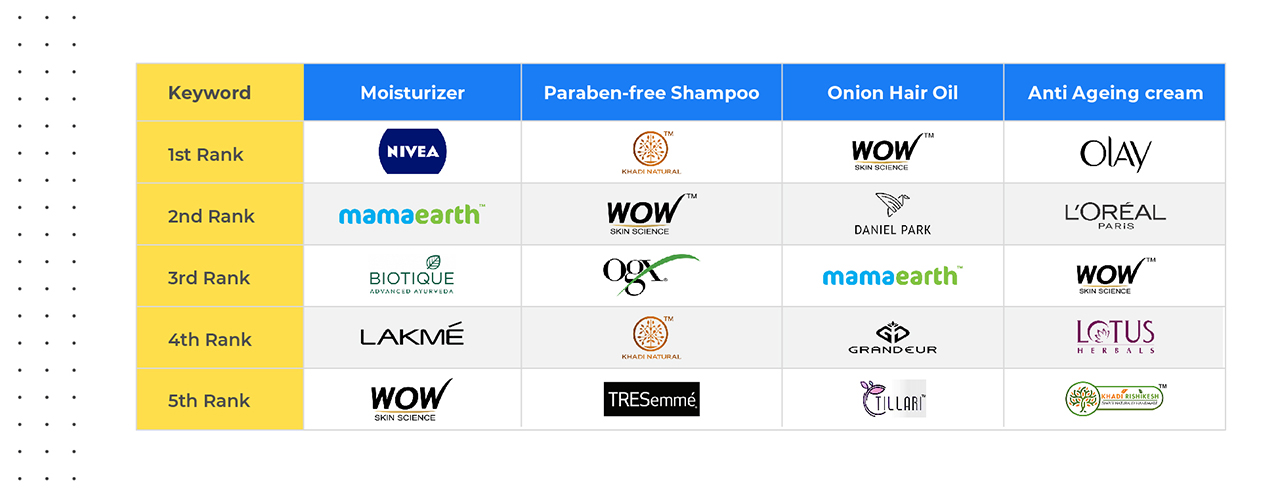

When selling on Amazon, brands need to make sure shoppers find their products with ease. Keyword searches are the top ways consumers discover and find products across eCommerce sites. We tracked search visibility for the following keywords to see which brands had the highest share of search and appeared on the 1st page on Amazon.

Be in any product category – moisturizers, shampoo, anti-aging cream, Mamaearth & WOW featured against most keywords, showing popularity among customers. WOW Skin Science raised $50 million in April 2021, and Mamaearth raised $50 million in July 2021. These two fresh-faced brands have built credibility among health- and environment-conscious users. They are big competitors when it comes to natural and toxin-free products. It’s their high product visibility in multiple categories that is likely leading to better discoverability, higher sales & increased valuation, and brand value.

In the male grooming space, we observed that established brands like Nivea, Old Spice, and Park Avenue had a lower share of search than new D2C brands like Beardo, The Man Company, Bombay Shaving Company, and Ustraa. Here’s clear proof of concept that brands need to evolve and adapt their Digital Shelf to selling online if they want to beat the competition.

Who were the Amazon Bestsellers?

Products on Amazon that have the highest sales in their respective categories are called Amazon Bestsellers. The Amazon Bestsellers rank is based on product sales and sales history where the list undergoes an hourly update. The bestseller ranking or bestseller badge is available in the product information section on the product page. The rankings are determined by comparing sales and historical data with products in the same category or subcategory.

Brands can make it to Amazon’s bestseller list by optimizing their listings, encouraging reviews, and listing products in the relevance of categories. Although Amazon does not consider reviews for product ranking, they help users convince them to buy your product.

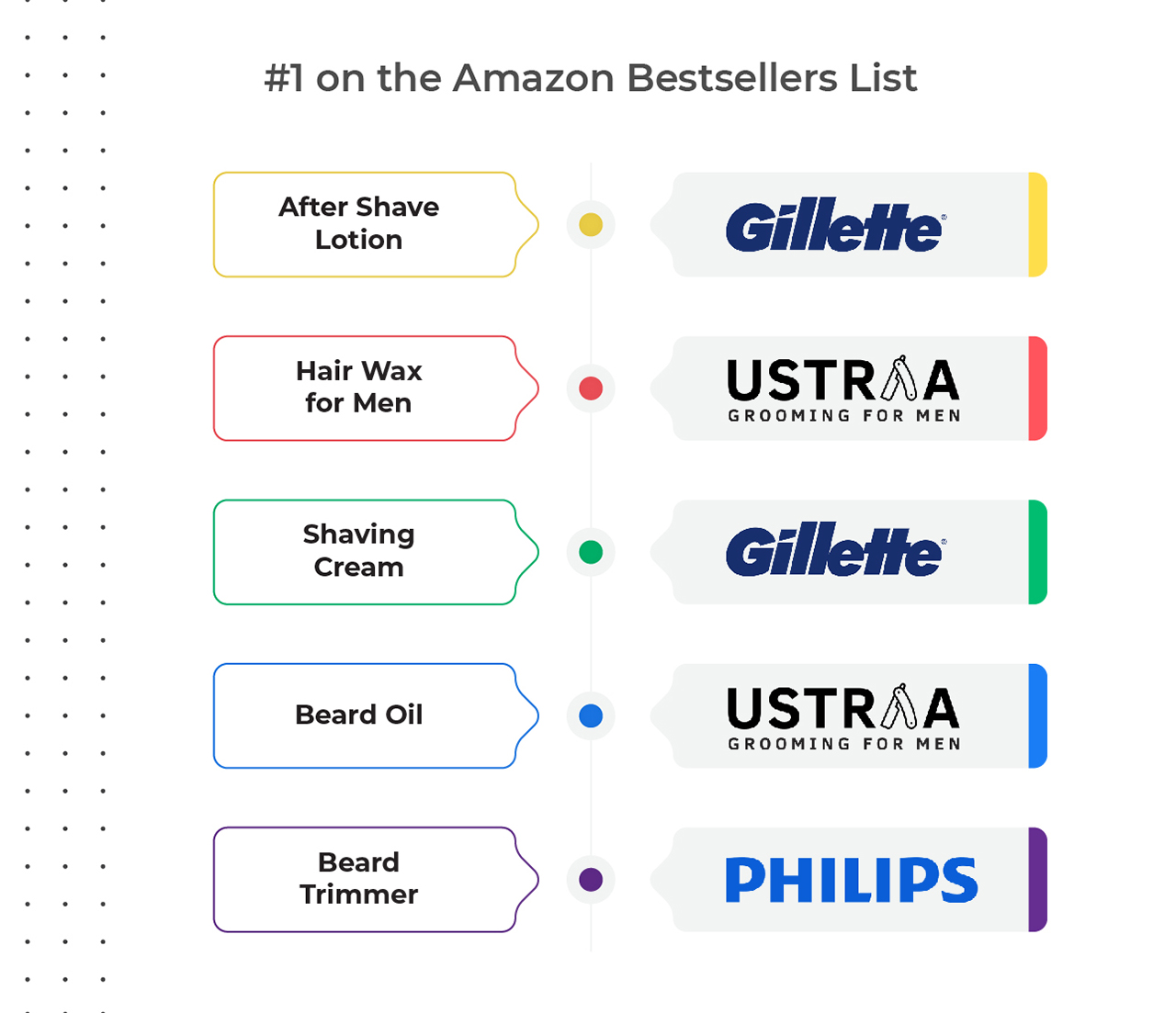

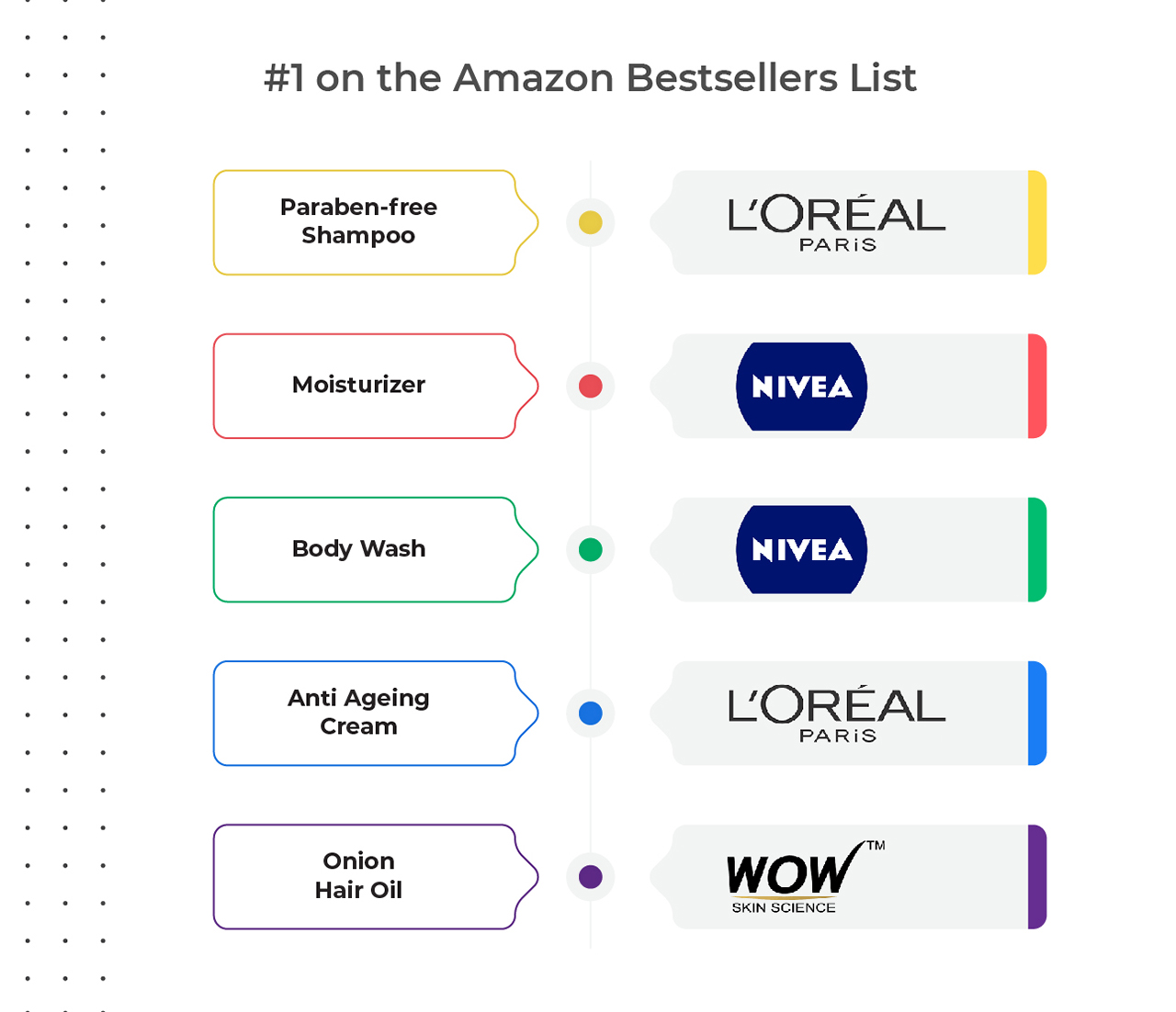

Here are the Brands we say that made it to #1 on the Amazon BestSeller List for the following product categories.

Gillette made it to the top in the aftershave lotion and shaving cream category, while D2C brands Ustraa made its mark bearing number 1 on Amazon Bestseller list for hair wax for men and beard oil.

Products from Nivea and L’Oreal made it to #1 seller in 2 categories each. Interestingly, in the Paraben-Free shampoo category, when D2C brands like WoW, Mamaearth have a stronger value proposition, traditional brand L’Oreal had the best-selling product.

L’Oreal must’ve pulled various levers and built a robust Digital Shelf to get to the top – from optimizing their content, ensuring product availability, tracking ratings and reviews, and proper competitive pricing.

Conclusion

An increase in new D2C brands in popular and trending categories has led to increasing competition. Unless a brand can position itself in front of the target audience and command their attention right away, another brand can step in and grab the sale. Do you know if your brand is prepped and ready to make an impact on marketplaces like Amazon? Or simply just wondering if your Digital Shelf is optimized with the right price, discounts, reviews, and keywords? Our team at DataWeave can help! Reach out to our Digital Shelf experts to learn more!

Book a Demo

Login

For accounts configured with Google ID, use Google login on top.

For accounts using SSO Services, use the button marked "Single Sign-on".