The power to impose tariffs on foreign countries is one of the most impactful measures a government has at their disposal. The government can use this power for various reasons: to punish rivals, equalize trade, give domestic products a comparative advantage, or collect more funds for the federal government.

Whatever the reason, tariffs have real-world impacts on brands and retailers selling in a global economy. They effectively make products more expensive for some and comparatively cheaper for others. Since tariffs can be added or removed at the drop of a hat, retail executives, category managers, and pricing teams trying to keep up have their work cut out for them.

You’ve come to the right place if you’re wondering how to prepare for and respond to potential tariffs. The answer lies in technology that will make you flexible when you need to react to policy changes. Establishing workflows and processes embedded with pricing intelligence can help you stay competitive even when global politics intercepts your business.

Understanding Tariff Impact

Before diving into tariffs’ implications on pricing strategies, we need to understand how tariffs work and the current economic environment. Tariffs are a government’s tax on products a foreign country sells to domestic buyers. You might remember President Trump’s expanded tariff policy in September 2018. It placed a 10% tax on $200 billion worth of Chinese imports for three months before raising to a rate of 25% in January 2019. At that time, an American buyer would pay the original price of the goods plus the tax to the American government. Many additional tariffs and counter-tariffs by other countries were enacted during Trump’s first term in office, including the European Union, Canada, Mexico, Brazil, and Argentina, resulting in a trade war.

Announcements of when, where, and on what new tariffs will be imposed are unpredictable. The only predictable thing is that this type of market volatility is here to stay. Pricing teams should adjust their mindsets to assume that volatility may always be on the horizon. This is because tariffs have many cost implications. Besides the flat rate imposed by the government on a certain product, tariffs have historically raised the price of all goods.

In economic terms, tariffs create a multiplier effect. Consider a tariff placed on gasoline imported from Canada. This measure may encourage American drilling but will have immediate ripple effects throughout the economy. Everything that relies on ground transportation will increase in price, at least in the short term.

This means that a fashion brand that sources and manufactures its entire line domestically will incur more costs since transportation will be more expensive. If fashion companies act like most companies, they will pass that added tax burden on to the consumer through higher prices. The company will make this decision based on how sensitive its consumers are to price increases, i.e., the elasticity of demand. These interwoven relationships extend across industries and products, affecting most retailers somehow.

Of course, category exposure varies by industry and sector. Tariffs are known to impact specific industries more than others. For example, steel, electronics, and agriculture products are at risk of price fluctuations based on their reliance on imported components. These have high category exposure. Some industries reliant on domestic production with stable input costs are less prone to category exposure. These include domestic power grids, natural gas, real estate, and handmade goods. No matter which industry you’re in, however, expect some spill over.

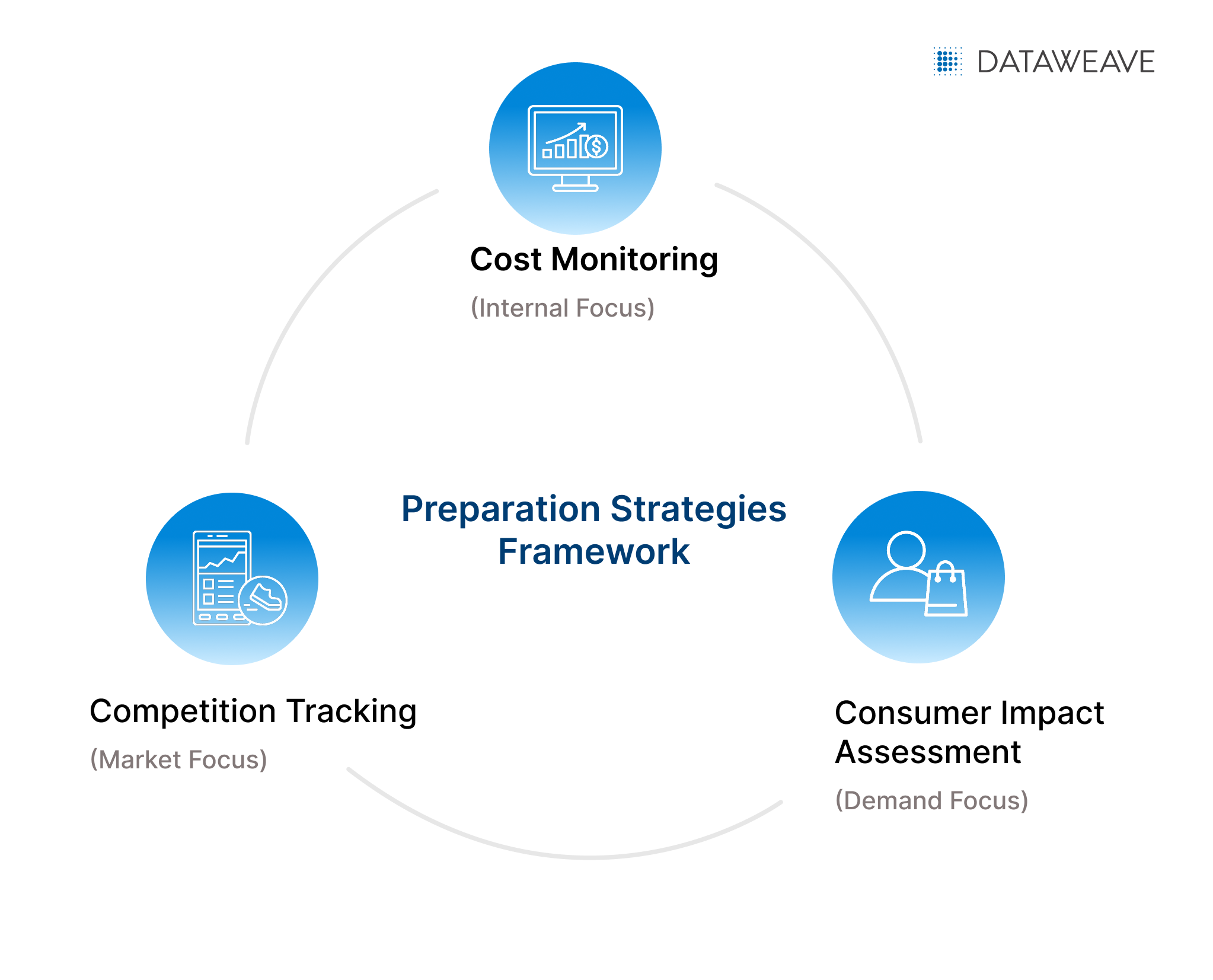

Preparation Strategies

Forward-thinking leaders can help position their teams for success in the face of pricing volatility brought on by tariffs. The key is to enable teams to sense disruptions quickly and provide a way to take corrective action that doesn’t diminish sales. Here are three strategies you can implement ahead of time that will help keep you competitive during tariff disruption.

Cost Monitoring

Start by getting a firm handle on internal and external costs. Understand and analyze fluctuations in the cost of raw materials, production, and supply chain for your business to operate. Make sure that your products are priced with pre-defined logic so changes in price on one SKU don’t create confusion with another. For example, faux leather costs rise while genuine leather stays the same. In that case, a leather version of a product should be raised to reflect the price increase in the pleather variation, not to devalue the perception of luxury.

Next, you will want to understand historical pricing trends as well as pricing indexes across your categories. These insights can help your teams anticipate cost fluctuations before they even arise and mitigate the risk that economic shifts create, even unexpected tariffs.

Competition Tracking

Tracking your competition is likely already a strategy you have in mind. But how well are your teams executing this important task? If they’re trying to watch for market shifts and adjust pricing in real time without the help of technology, things are likely slipping through the cracks.

Competitive intelligence solutions help retailers discover all competitive SKUs across the e-commerce market, monitor for real-time pricing shifts, and take action to mitigate risk. You need an “always-on” competitive pricing strategy now so that the second a tariff is announced, you can see how it’s affecting your market. This way, you can maintain price competitiveness and avoid margin erosion when competitors’ pricing changes in response to a tariff or other market shift.

Consumer Impact Assessment

The multiplier effect is felt throughout the supply chain when tariffs are implemented. The effect can affect consumers in a number of ways and cause them to become spending averse in certain areas. Often, during times of economic hardship, grocery items remain relatively inelastic. This is because consumers continue to purchase essentials regardless of price changes. Conversely, the price of eating out or home delivery becomes more elastic since consumers cut back on dining expenses when costs rise across their shopping basket.

You need to establish clear visibility into the results of your pricing changes. The goal should be to monitor progress and measure the ROI on specific and broad pricing changes across your assortment. Conducting market share impact analysis will also help you determine if you are losing out on potential customers or whether a decline in sales is being felt across your competition. Impact analysis tools can help your company check actual deployed price changes in real time.

Response Framework

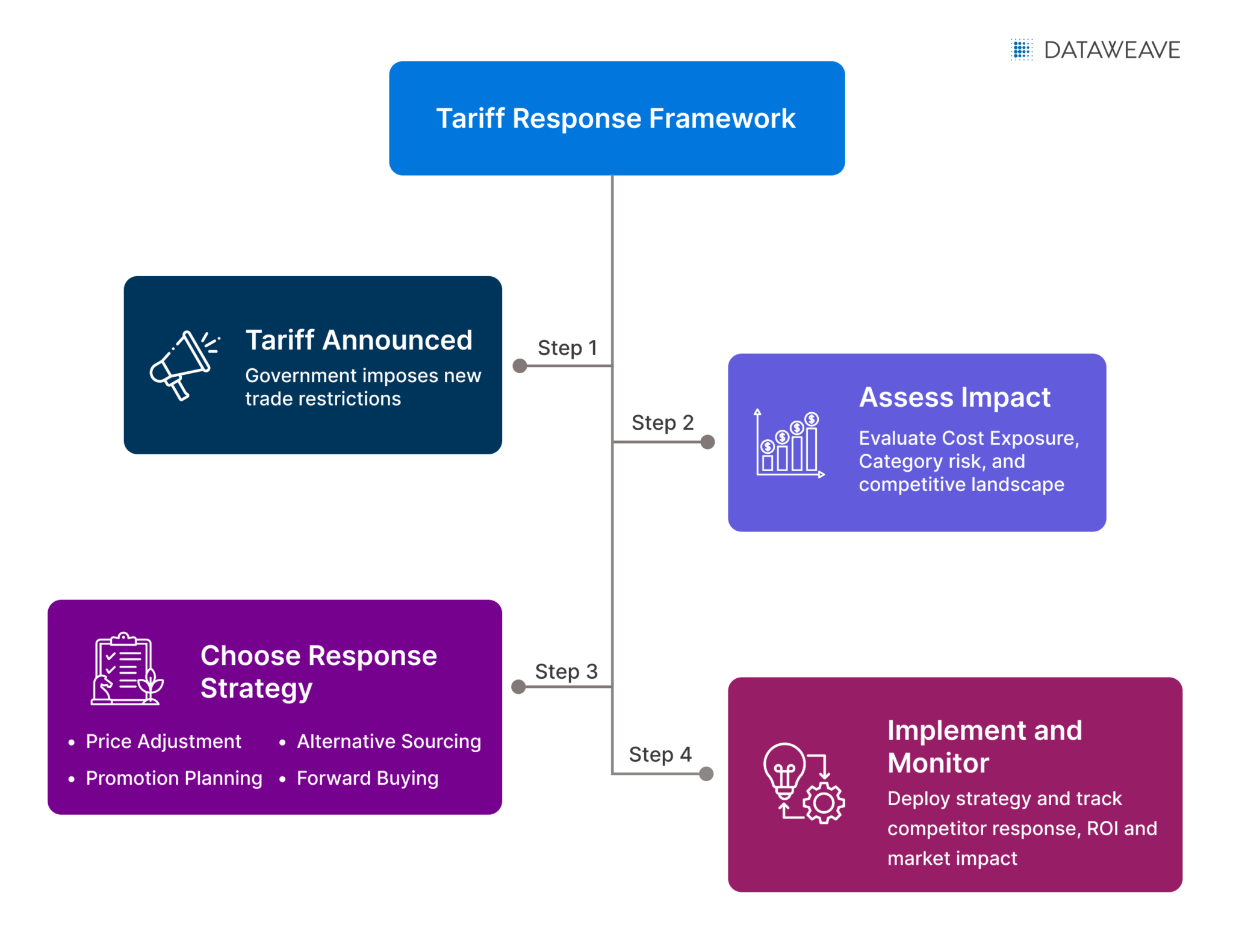

Once you’ve prepared your team with strategies and technologies to set them up for success, it’s time to think about what to do once a tariff is announced or implemented. Here are three real-time decision-making strategies you should consider before your feet are to the fire. Having these in your back pocket will help you avoid financial disruption.

Price Adjustment Strategies

Think about how you strategically adjust prices. These could include percentage increases, flat rate increases, or absorbed via other strategies like bundling. You should also determine a cost increase threshold that you’re willing to absorb before raising prices. Think about the importance of remaining price attractive to consumers and weigh the risk of increasing prices past consumers’ ability or willingness to pay.

Promotion Planning

Folding increased costs into value-added offerings for consumers can be a good way to retain customer sentiment and sales volume without negatively affecting profit margins. You can leverage discounts, promotions, or bundling options to sell more of an item to a customer at a lower per-unit cost.

What you don’t want to do is panic-adjust prices in response to tariffs of competitor moves. Instead, you can use a tool competitor intelligence solutions to watch if your competition is holding prices steady or adjusting. With full information about pricing at your disposal, you can make better decisions on your promotional strategy and not undercut yourself or lose customer loyalty.

Alternative Sourcing

Let’s face it: putting all your eggs in one basket is bad for business. Instead of relying solely on a single supplier for production, you should have a diverse set of suppliers ready and able to shift production when tariffs are announced. If a tariff impacts Chinese exports, having a backup supplier in Vietnam can prevent added costs entirely. You can also consider strategies like bulk pricing, set pricing, or shifting entirely to domestic suppliers.

Forward Buying

Proactively stockpile inventory by purchasing large quantities of at-risk products before tariffs take effect. This strategy locks in lower costs and ensures supply continuity during disruptions. However, balance this with careful demand forecasting to avoid overstocking, which ties up cash flow and incurs storage costs. Use historical sales data and tariff implementation timelines to optimize order volumes—this is especially effective for products with stable demand or long shelf lives.

Market Intelligence Requirements

Preparing your pricing teams and giving them a framework upon which to act when tariffs are announced doesn’t have to be complicated. You can get access to the right data on costs, competitors, and consumer behavior with DataWeave’s pricing intelligence capability.

We provide retailers with insights on pricing trends, category exposure, and competitor adjustments. Our AI-powered competitor intelligence solutions allow you to get timely alerts whenever a significant change happens. This can include changes to competitor pricing and category-level shifts that you’d otherwise react to when it’s too late.

These automated insights can also help you track historical pricing trends, elasticity, and margin impact to construct a clear response framework in an emergency. Additionally, our analytics capabilities can help you identify patterns to power pre-emptive pricing and promotional strategies.

Getting the right pricing intelligence strategy in place now can prevent disaster later. Think through your preparedness strategy and how you want your teams to respond in the event of a new tariff, and consider how much easier reacting accurately would be with all the data needed at your fingertips. Reach out to us to know more.

Book a Demo

Login

For accounts configured with Google ID, use Google login on top.

For accounts using SSO Services, use the button marked "Single Sign-on".